income tax rates 2022 south africa

The budget proposes the adjust personal. Calculate how tax changes will affect your pocket.

Part 2 Of Tax For Online Teachers In South Africa In 2022 Online Teachers Teachers South Africa

Web Tax rates are proposed by the Minister of Finance in the annual Budget Speech and fixed or passed by Parliament each year.

. The 2022 budget speech delivered 23 February 2022. Web Quick Tax Guide 202223 South Africa 3 Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2023 Taxable income Rate of tax R0 R226. 2022 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa.

Web 2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000. Web Tax rates from 1 March 2022 to 28 February 2023. Web International Tax South Africa Highlights 2022.

Web Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income. Personal Income Tax Rate in South Africa averaged 4124 percent from 2004 until 2020 reaching an all time. Web For the 2021 year of assessment 1 March 2020 28 February 2021 R83 100 if you are younger than 65 years.

If you are 65 years of age to below 75 years the tax. Web Year ending 28 February 2022. Effectively connected to a fixed place of business in South.

40680 26 of taxable. Web On this page you will see Individuals tax table as well as the Tax Rebates and Tax Thresholds scroll down. Web The Personal Income Tax Rate in South Africa stands at 45 percent.

Reduction in corporate income tax rate and broadening the tax base. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Taxable Income R Rate of Tax R 1 91 250 0 of taxable income.

Ad Compare Your 2022 Tax Bracket vs. R38 916 26 of taxable income above R216. Discover Helpful Information And Resources On Taxes From AARP.

R216 201 R337 800. 18 of taxable income. Rate of tax R R1 R216 200.

Information is recorded from current. Web 2022 Tax Tables. Web South Africa.

Web Sage Income Tax Calculator. 18 of taxable income. Web The current South African tax year runs from 1 March 2022 to 28 February 2023.

91 251 365 000 7 of. The same rates of tax are applicable to both residents and non-residents. This year over 3 million.

In this section you will find the tax. Web 2022 Tax Filing Season. Web 8 rows Non-residents are taxed on their South African sourced income.

29 June 2022 The South African Revenue Service SARS has made significant changes to the 2022 Tax Filing Season. Your 2021 Tax Bracket To See Whats Been Adjusted. 2023 tax year 1 March 2022 28 February 2023 23.

The tax season when people are required to file their income tax returns is. Web Capital Gains Tax CGT See here how the changes in tax rates affect the age groups per income level from last year to this year. Web Years of assessment ending on any date between 1 April 2022 and 30 March 2023.

For the latest tax developments relating to South Africa see. You are viewing the. Updated January 2022.

Web On 23 February 2022 South Africas Minister of Finance Mr Enoch Godongwana presented the 2022 Budget. Individuals and special trusts Taxable Income R Rate of Tax R.

Find Out What To Do With A 1099 Form How To Include It With Your Personal Taxes And How To File This Type Of Income Tax Income Tax Return Income Paying Taxes

Top Flights Travel Infographic Chart Route

Explainer Which Countries Have Introduced A Carbon Tax World Economic Forum

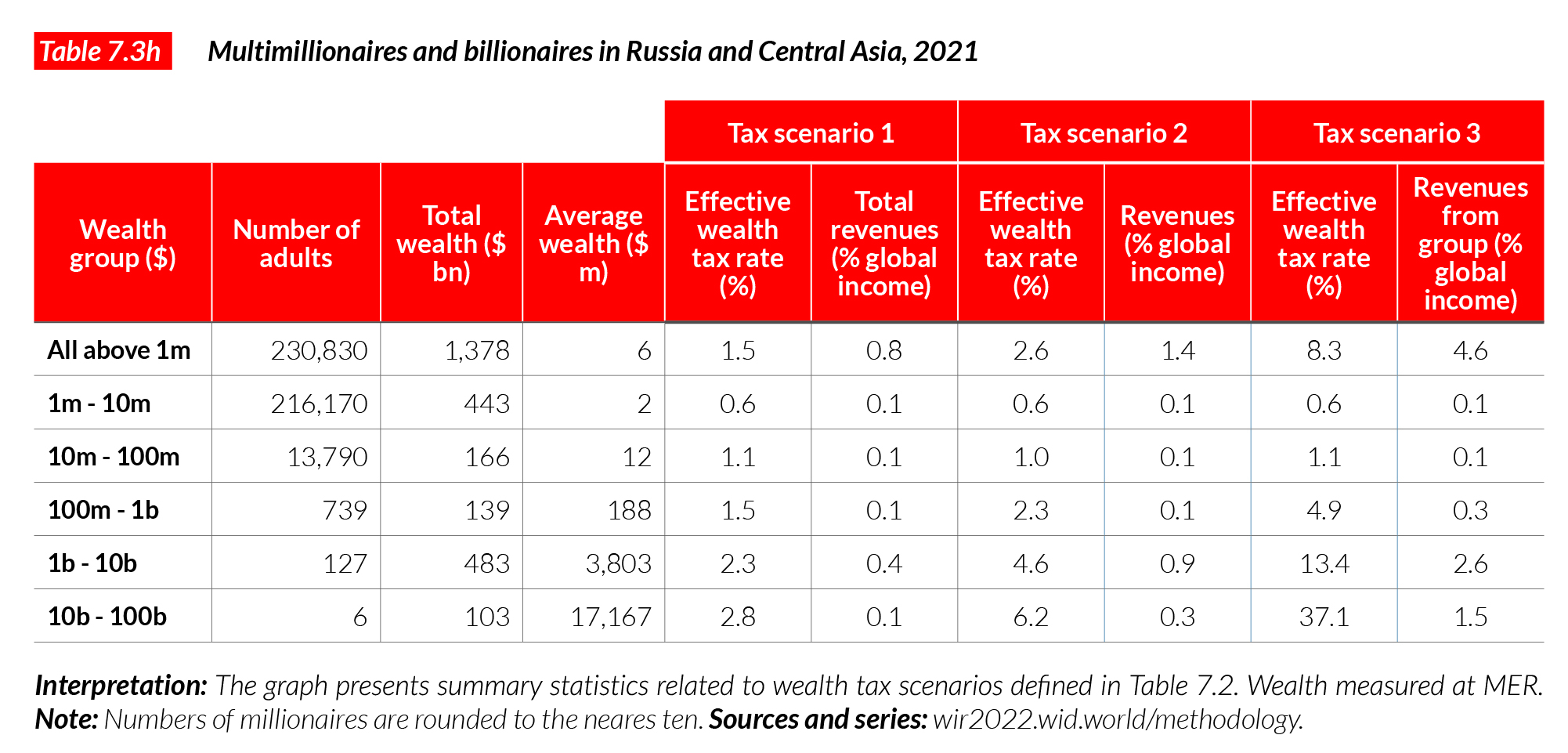

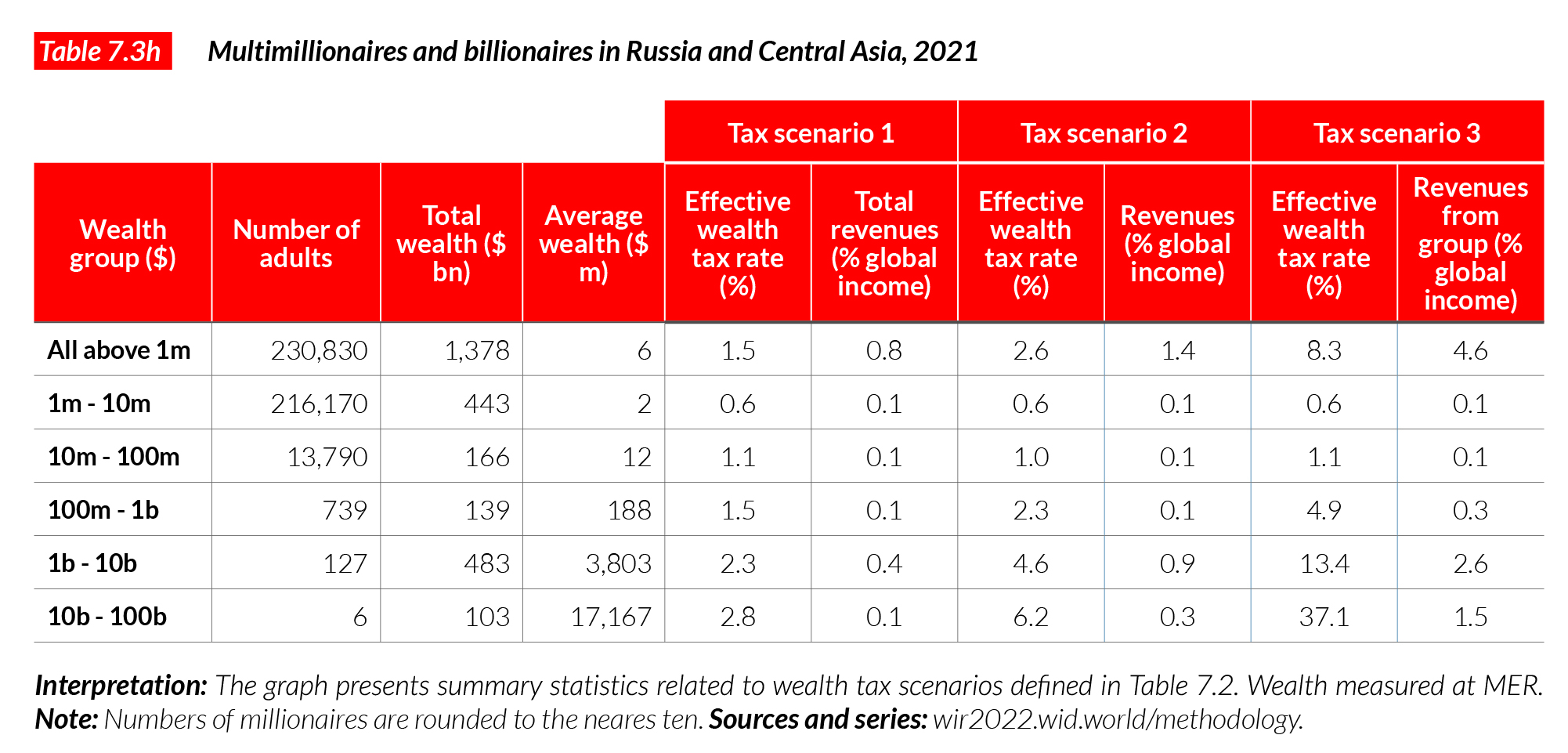

The World Inequalityreport 2022 Presents The Most Up To Date Complete Data On Inequality Worldwide Global Wealth Ecological Inequality Income Inequality Since 1820 Gender Inequality

The Most Popular Consumer Brands In The World And The United States Vivid Maps In 2022 Most Popular Beers Coffee Shop Branding Popular

Tax Guide 2021 2022 Tax Consulting South Africa

The Most Humid Cities In The World Mapped Vivid Maps In 2022 American History Timeline Infographic Map Humidity

Fnb Apologises To Customers For The Inconvenience Caused Due To Some Functionality Being Temporarily Unavailable On Financial Private Banking Money Management

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Small Business Financial Statement Template Inspirational Free Business Financial Statement Temp Business Budget Template Financial Analysis Statement Template

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Salary Life Money Hacks Smart Money

Personal Income Tax Has Untapped Potential In Poorer Countries

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Jakemart Usps Scott O138 14c Postal Card Rate D 1985 Lot Of 6 Plate Block Mint In 2022 Unique Stamps Mail Stamp Cards

Personal Income Tax Has Untapped Potential In Poorer Countries

How Do Corporate Taxes For Small Businesses Vary Around The World Vivid Maps In 2022 Small Business Tax Business Tax Small Business

New Kiddie Tax Rules Make It Possible To Shift A Limited Amount Of Investment Income To A Child To Be Taxed At A Different Rate Investing Tax Rules Tax Season